Size Matters: How Will The Shift In Household Size Affect The Real Estate Market?

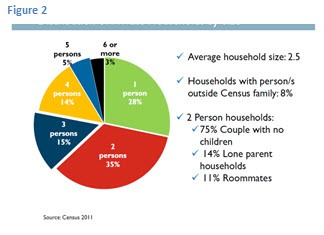

Whether you are investing in real estate in Canada or the US, the composition of housing is changing. Statistics Canada, in its recent census, shows that one-person households continue to increase as a proportion of household size. In 1961, 25% of households were comprised five people and 14% were comprised of one person. Today, this has completely reversed. Twenty eight percent of all households in Canada are comprised of one person and eight percent are comprised of five people (see figure 1). Two person or fewer households make up 59% of all households in Canada (see figure 2).

Whether you are investing in real estate in Canada or the US, the composition of housing is changing. Statistics Canada, in its recent census, shows that one-person households continue to increase as a proportion of household size. In 1961, 25% of households were comprised five people and 14% were comprised of one person. Today, this has completely reversed. Twenty eight percent of all households in Canada are comprised of one person and eight percent are comprised of five people (see figure 1). Two person or fewer households make up 59% of all households in Canada (see figure 2).

What are the ramifications for real estate investors? Well the very good news is that as the Canadian population continues to increase (5.9% from 2006 to 2011 and has the highest population growth of all the countries in the G8), the number of people requiring housing also increases. This is compounded further whereby the proportion of homes is also increasing compared to the population: in the past if, for every 100 people, 25 households were created for example, presently, 36 households are needed.

What are the ramifications for real estate investors? Well the very good news is that as the Canadian population continues to increase (5.9% from 2006 to 2011 and has the highest population growth of all the countries in the G8), the number of people requiring housing also increases. This is compounded further whereby the proportion of homes is also increasing compared to the population: in the past if, for every 100 people, 25 households were created for example, presently, 36 households are needed.

The Average Rent for a Studio in San Francisco is $2,100

The knowledge of the growing number of single-person homes can serve developers and investors seeking to capitalize on a shifting housing landscape. In cities with sky high housing costs such as Vancouver, Toronto, and San Francisco, micro-units (220-290 sq feet) can be reasonable alternatives to unaffordable mortgages and rents. In the city of San Francisco for example, 2 in 5 people live alone and the average rent for a studio apartment is $2100. Burns Block in Gastown (see figure 3) is comprised of micro lofts, fetching a monthly rent of $850 including cable and internet. These units are only affordable because of their tiny footprint. They provide housing to an underserved market that desires to live alone but cannot or does not want to pay the exceptionally high rents or mortgages. Residents of these units are often single professionals, students and single baby boomers who want the vitality that city life brings.

The knowledge of the growing number of single-person homes can serve developers and investors seeking to capitalize on a shifting housing landscape. In cities with sky high housing costs such as Vancouver, Toronto, and San Francisco, micro-units (220-290 sq feet) can be reasonable alternatives to unaffordable mortgages and rents. In the city of San Francisco for example, 2 in 5 people live alone and the average rent for a studio apartment is $2100. Burns Block in Gastown (see figure 3) is comprised of micro lofts, fetching a monthly rent of $850 including cable and internet. These units are only affordable because of their tiny footprint. They provide housing to an underserved market that desires to live alone but cannot or does not want to pay the exceptionally high rents or mortgages. Residents of these units are often single professionals, students and single baby boomers who want the vitality that city life brings.

Questions however remain about the sustainability of this housing type. What if the trend shifts away from single-person households as the number of baby boomers shrink and Gen-Y gets older, married and has children? Some developers are building units with this thought in mind by designing micro-units that can easily be combined to create larger apartments.

The Other Side of the Coin is the Growth in Huge Multi-Generational Homes

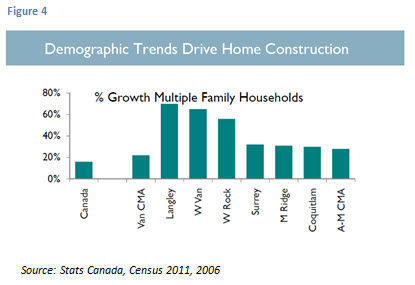

The reason for the growth in the Canadian population is attributed solely to immigration (Canada is currently experiencing a zero population growth the same number of people are dying as are being born). As that information relates to real estate, research indicates that immigrants tend to rent longer than current residents who are looking for housing. Although it depends on the type of immigrant class  (investor, skilled worker, family as examples), 50% of all immigrants to Canada are still renting four years later. Increasing immigration then, from an investors point of view, is a very good thing. Yet, housing data show that many immigrants coming to Canada on a Family Class visa often choose to NOT live in single person households, choosing to have more occupants per unit than typically seen in North America. Additionally, the major countries of origin of many foreign born residents in the last decade tend to favour multi-generational households more than non-foreign born residents. This is very apparent in particular markets in British Columbia with large populations of Southeast Asian immigrants. Figure 4 demonstrates the huge spike in multigenerational home growth in three markets in BC.

(investor, skilled worker, family as examples), 50% of all immigrants to Canada are still renting four years later. Increasing immigration then, from an investors point of view, is a very good thing. Yet, housing data show that many immigrants coming to Canada on a Family Class visa often choose to NOT live in single person households, choosing to have more occupants per unit than typically seen in North America. Additionally, the major countries of origin of many foreign born residents in the last decade tend to favour multi-generational households more than non-foreign born residents. This is very apparent in particular markets in British Columbia with large populations of Southeast Asian immigrants. Figure 4 demonstrates the huge spike in multigenerational home growth in three markets in BC.

Developers and real estate investors who are looking at purchasing in these high priced markets will be well served in the next decade to consider the demographic landscape of their potential buyers and renters. Many cities have yet to jump on board with this micro-apartment movement fearing a decrease in the livability of a community. Consult with City Planning Departments to find out about zoning regulations and square footage requirements. What works in one city, may not work in another.

Melanie Reuter is the Director of Research for The Real Estate Investment Network and has been with the company for seven years. She has a Master of Arts Degree from California State University, San Bernardino and a Bachelors Degree from Simon Fraser University. To read more of Melanies insights, please go to www.reincanada.com.

Melanie Reuter is the Director of Research for The Real Estate Investment Network and has been with the company for seven years. She has a Master of Arts Degree from California State University, San Bernardino and a Bachelors Degree from Simon Fraser University. To read more of Melanies insights, please go to www.reincanada.com.