Cross-Border Shopping: 7 Tax Tips for US Investors

By Peter Cuttini

Tax season has arrived for the US and Canada, but for those who have done some cross-border shopping to purchase US real estate, they have extra obligations to ensure they are in compliance with both the Internal Revenue Service (IRS) and the Canada Revenue Agency (CRA). Below are some tips, and filing deadline information, to ensure your tax filings go smoothly.

1) Ensure cross-border knowledge

One of the biggest issues for many clients is not choosing a tax specialist who is familiar with both sides of the border. We have seen Canadians being advised on structures that, while they work from a US perspective, have led to double taxation for the Canadian taxpayer. We often work with clients who would like us to help fix things after experiencing these situations.

2) Beware of late filing penalties

We have seen a significant increase in late filing penalties being assessed by the IRS. In fact, these late filing penalties are now being assessed for failure to file information forms on a timely basis. (In other words, no taxes are owing, but you are informing the IRS of specific information.) We have seen one taxpayer whose US tax advisor did not file Form 3520 to report the foreign ownership of the US Corporation. The IRS assessed a $10,000 penalty for each of the three forms that were not filed for a total of $30,000! In other words, observing these numbers can merely illustrate a point: paying your taxes on time might be crucial. Taxpayers should not only pay their taxes on time but also take advantage of early tax payments that can reduce their amount of tax.

3) Make the right elections: Gross vs net taxes on monthly rental income

In most circumstances, taxpayers elect to treat the income from their personally owned rental property as effectively connected income to the United States. This will tax the rental income on a net basis at the U.S graduated tax rates.

If you do not make this election, the tax will be 30% of the gross rent. To make this election the owner must provide a W8-ECI to the property manager or renter. If not provided, the property manager or renter must withhold 30% of the gross rent to the IRS on a monthly basis.

4) Depreciate and carry-forward

Unlike Canada, annual depreciation of the property and all other capital assets is mandatory.

In most cases, real estate rentals are considered passive investments. If the property is operating at a net loss for U.S. tax purposes, the loss will be carried forward to a future year to be applied against future income.

5) Consider a Limited Liability Partnership

Over the past few years, we have seen an increase in U.S. property being purchased by Canadians using a Limited Liability Partnership ( LLP ) structure. The LLP structure can be used to minimize legal liability risks, while allowing preferential tax treatment of a flow through entity to the individual partners. Essentially, the income flows through to each partner of the partnership, based on their percentage ownership of the partnership.

Each partner will receive a K-1 from the partnership, which will indicate the partner s proportional share of any income or loss from the partnership. Each partner will then have to report this income on their U.S. tax return.

6) Disclose that you re a Canadian to the IRS

For those Canadians who own property in a US Corporation, whether that ownership is by a Canadian corporation or individual, you must include specific forms with the tax return which disclose this foreign ownership. This is very important as we have seen a significant increase in penalties from the IRS for failure to file these forms as noted above.

7) Disclose that you have US assets to the CRA

The IRS and CRA mirror each other closely in this regard for reporting requirements. You must report the income from the property on your Canadian tax returns, whether personal or corporate. There are stiff penalties handed out by the Canadian government for failing to do so, and so far, it appears that they are following these rules very strictly. They have also implemented new forms this year, requiring even more information from taxpayers, so work with your accountant sooner rather than later to ensure you stay onside.

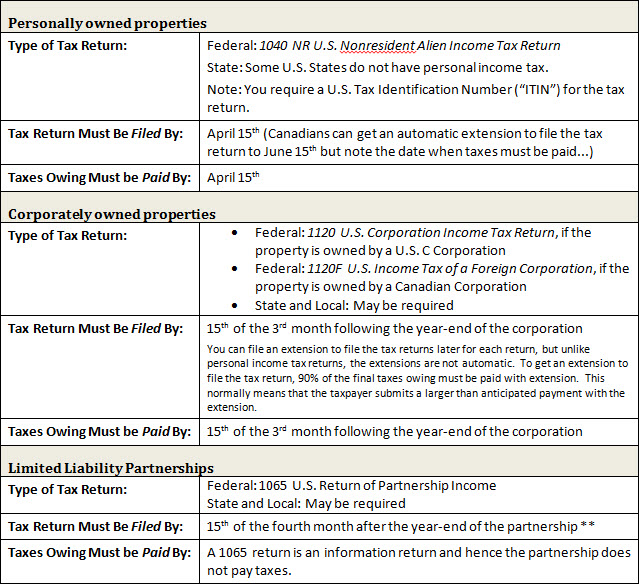

US Tax Filing Deadlines

Peter Cuttini, CPA, CA, LPA, CPA (Illinois) is a real estate investor and cross-border accountant. He often speaks on cross-border issues and has written numerous articles on the topic.