Passive Real Estate Strategies: REITs vs. Multifamily Apartment Syndication

This post is written by Trusted Partner, Faris Capital Partners. To become a contributing editor, please contact our Real Estate Investor Solutions Specialist, David Maxwell at david@reincanada.com.

Many investors seek the benefits of passive income through real estate, yet not all are keen on assuming the role of a landlord, which involves property management and handling emergencies.

For those investors desiring exposure to real estate without the landlord responsibilities, two primary options emerge: Real Estate Investment Trusts (REITs) and multifamily apartment syndication. Both options provide opportunities for generating passive income through real estate investments.

However, to make an informed decision between the two, understanding their distinctions is crucial.

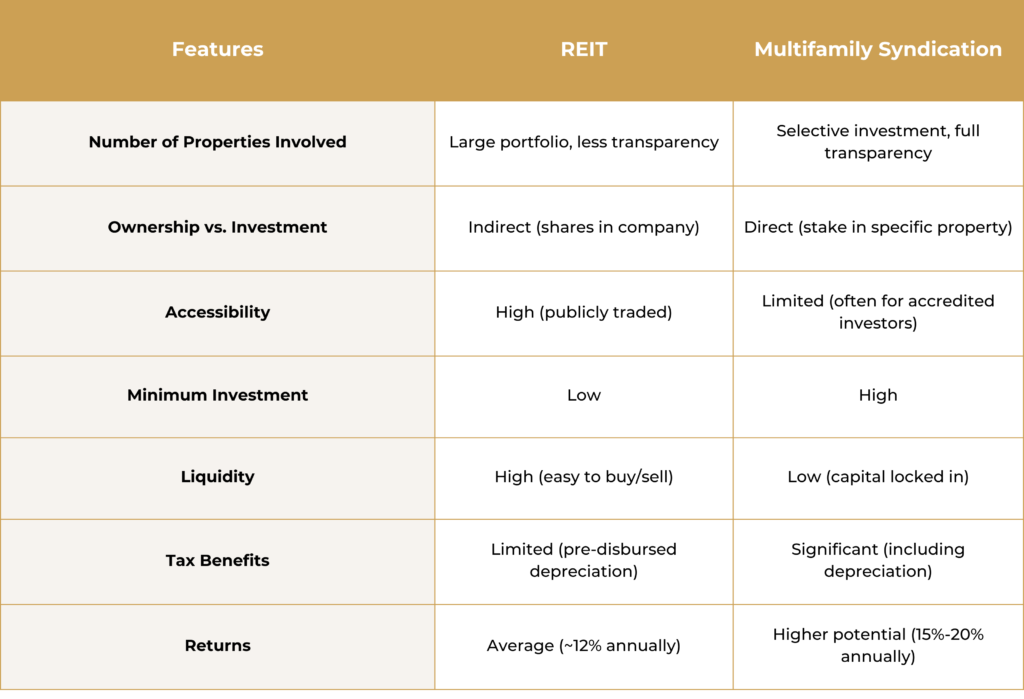

- Number of Properties Involved:

Investing in a REIT typically entails exposure to a larger number of properties, as you’re investing in a company with an established real estate portfolio spanning various markets. However, as an investor, you lack control over which specific properties the REIT acquires.

In contrast, real estate syndication offers more flexibility. Depending on the syndicator’s approach, investors may have the option to invest in a single property or participate in a fund encompassing multiple assets. For instance, it allows investors to have a stake in each asset within the fund, providing transparency regarding asset location, unit count, and financial details. - Ownership vs. Investment:

In multifamily apartment syndication, direct ownership of the property is established through collective investment in the asset via a group arrangement. Together with fellow investors and general partners, participants hold ownership of the LLC or entity holding the property.

In contrast, investing in a REIT involves purchasing shares in a company, thereby lacking direct ownership of the real estate properties in the REIT’s portfolio. Shareholders do not possess underlying real estate assets; instead, they hold shares in the company that owns those assets. - Accessibility:

REITs typically offer greater accessibility as the majority are listed on major stock exchanges, akin to other publicly traded stocks. This public listing enhances the ease of investing in REITs.

In contrast, real estate syndications can pose more challenges in terms of access. Some syndication opportunities are not publicly advertised, necessitating connections with individuals who have access to such investments. Additionally, many real estate syndications are exclusively available to accredited investors, presenting a potential barrier for some investors. - Minimum Investment:

Investing in a REIT mirrors the process of purchasing stocks: you acquire shares, and that’s all. It’s possible to invest even a small sum, which constitutes a significant advantage of REITs over real estate syndication. This accessibility to invest a modest amount appeals to many investors, especially those embarking on their journey in real estate investment.

Conversely, multifamily apartment syndication deals typically entail higher minimum investments and are better suited for seasoned investors. The specific minimum investment varies depending on the property. - Liquidity:

REITs provide investment liquidity, allowing shareholders to buy or sell their shares at any time without restriction. Funds are not tied up for a specified duration.

Conversely, investing in multifamily apartment syndication entails locking in funds until the conclusion of the deal, as capital is directly invested in real property. Depending on the deal’s structure, investors may or may not receive an equity share upon completion. - Tax Benefits: Syndication vs. REITs

Direct investment in real estate, as seen in multifamily apartment syndication, offers numerous tax deductions, notably including depreciation. In certain instances, such as with accelerated depreciation, these benefits can be substantial, often serving as a compelling reason to invest for some individuals.

Conversely, the tax advantages associated with investing in REITs are comparatively less significant. While depreciation benefits are still present, they are factored in before dividends are disbursed, precluding additional tax breaks. Moreover, the depreciation cannot be utilized to offset other sources of income. - Returns:

The potential returns for each investment can vary significantly based on various factors such as the specific property, management expertise, and market conditions. In general, multifamily apartment syndication tends to offer higher average returns compared to REITs, with potential annual returns of 15% – 20%. Whereas REITs typically yield an average annual return of around 12%.

Publicly traded REITs may experience volatility in returns, influenced by economic variables such as interest rates and unemployment rates.

Multifamily apartment syndication not only represents a safer option in real estate investment but also presents the opportunity for superior returns. This combination makes it an attractive choice for investors seeking passive income from real estate.

In summary, real estate syndication provides more robust tax benefits for investors in real estate. While investing in REITs remains an option, this aspect merits consideration when evaluating potential investments.

Interested in exploring syndication investments? Partner with Faris Capital Partners.

Investing in real estate can yield positive cash flow, whether you opt for a REIT or delve into real estate syndication. Each investment avenue presents its own set of advantages and disadvantages concerning cash flow, tax deductions, direct ownership, depreciation benefits, and minimum investment requirements.

REITs offer higher liquidity and require smaller minimum investments, whereas multifamily apartment syndication deals offer enhanced safety, potentially greater returns, and superior tax benefits.

For accredited investors seeking to capitalize on the advantages of multifamily apartment syndication, collaborating with an experienced syndicator like Faris Capital Partners is paramount.

Faris Capital Partners specializes in acquiring and managing income-generating properties, focusing primarily on multifamily apartments. Renowned among accredited investors, Faris Capital Partners employs a low-risk business model that aims to maximize benefits.

From inception to completion, Faris Capital Partners oversees the entire process, including identifying optimal real estate opportunities and negotiating purchases and financing on behalf of investors.

Interested in discovering more? Schedule a call with Faris Capital Partners today.