The RRSP Effect: Link Your RRSPs to Real Estate

By Brian Pulis

For the majority of people, retirement timing is a matter of when not if. The question is: will you be ready in time? You cant turn back the clock, but you can educate yourself about the opportunities that your financial advisor may not have told you about, possibly because some of these investments may be beyond their areas of expertise or authority to sell.

Many savvy real estate investors use their RRSPs and TFSAs to invest in private real estate projects.

Get to Know Your Retirement Investment Options

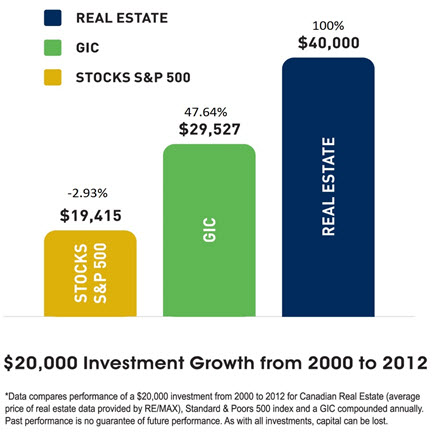

Think of your RRSP like a big basket. Ultimately, you get to decide what goes in it. Many people are under the impression that the traditional RRSP is limited to investments like GICs, mutual funds, bonds and stocks. However, theres much more available than that. Your RRSP could look very different, and so could your returns.

Large Investors are Depending on Private Investments

Consider, for example, the change in strategy that took place within OMERS (the Ontario Municipal Employees Retirement System). In 2004, the fund, which has pension commitments to more than 400,000 members in Ontario, had an investment mix that featured 82% public market and 18% private investment holdings. But a new strategy adopted in February 2004 started OMERS on the road towards an asset mix goal of 53% public market and 47% private holdings.

The principal reason it was done was to reduce our exposure to the volatility of the capital markets, especially public equity. The second reason was to acquire assets that would give us as predictable as possible long-term cash returns to fund the pension plan. -Michael Nobrega, President and CEO of OMERS

The desire for predictable long-term growth is reflected in the change in approach OMERS has taken. And its now an option available to every future retiree within the organization.

Expert Resources are Widely Available to Proactive Investors

There is information available about RRSP mortgages and Private Investments such as Limited Partnerships, but its not always readily accessible. Rarer still are professionals who know the ins and outs to discuss these options with you. RRSP-eligible Limited Partnerships are often marketed to the very wealthy, and are hard to locate. Truthfully, there are ample opportunities for average investors to benefit, but access is often more about who you know.

The fact is, with the likelihood of government support for retirees dwindling in the future, and with the vast number of Baby Boomers approaching retirement, the onus to gather and maximize investments is falling squarely on the shoulders of the average citizen. Thats a lot of responsibility to carry, which is why its so compelling to look at all alternatives, and to spend some time understanding each option available. Its not just about asking questions to seek alternative solutions; its about finding out what the questions are.

If you are a member of a real estate group, chances are you have access to a network where answers and information can be found. Your colleagues can point you in the direction of RRSP-eligible real estate investment opportunities that are available to the public or to Exempt Market Dealers (EMD) that represent RRSP-eligible real estate products, such as Sloane Capital, which represents private companies across Canada that are specialized in real estate.

Real Estate Knowledge Can Empower Successful Investment Strategies

The world we live in is currently in a state of flux. While there will always be a certain degree of uncertainty, the best way to make good decisions is to know and to understand what your options are. Hope and patience are admirable qualities, but they shouldnt be the guiding factors for your investment portfolio.

Truthfully, as time marches on towards your retirement, its not feasible to stop and wait for your investments to catch up to you. Instead, we all need to take responsibility for our investment choices. If our current set of choices isnt growing quickly enough, then we need to look carefully to responsible alternatives.

Brian Pulis has been investing in Real estate since 2002 and REIN member since 2003. Brian is the Co-Founder of Pulis Investment Group, which offers investors a Hands-Free, RRSP eligible opportunity to in invest in Apartment buildings.

Brian Pulis has been investing in Real estate since 2002 and REIN member since 2003. Brian is the Co-Founder of Pulis Investment Group, which offers investors a Hands-Free, RRSP eligible opportunity to in invest in Apartment buildings.