Sell or Refinance? The Agony and the Ecstasy

By Thomas Beyer

?The Agony and the Ecstasy? is a very worthwhile book about the painter and sculptor Michelangelo. Like a beautiful sculpture, say the Statue of David, or a masterful painting, say on the ceiling of the Sistine Chapel, it takes a huge amount of planning and masterful execution over months and years to arrive at a brief moment of ecstasy. The ecstasy in income producing real estate is not so much the monthly cash flow but the final big cheque on asset sale, or when you refinance (see more about a refinance mortgage here). Once you have owned an asset for a while you will always, always wonder: is it time to sell? Even if the original intention was a very long term hold, you will get the itch. It is true agony.

So, let?s analyze briefly when you should sell, and when you should not but rather hold and/or refinance instead!

The case to never sell:

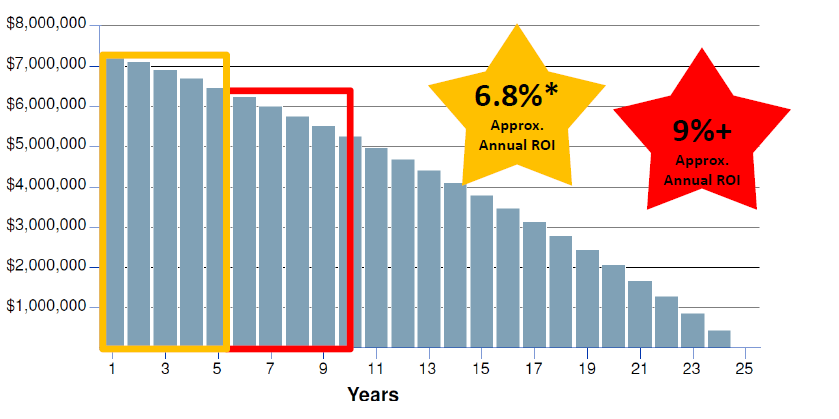

The chart below shows a typical mortgage amortized over 25 years. It shows that even in flattish markets one can make money and why it is so hard to lose money in an income producing asset class. The example shows an asset purchased for $10.5M with a $3M down payment (similar to an asset we own in Edmonton, AB with a $7.5M mortgage). In 5 years we pay down this mortgage by roughly $1.025M, which is about 34% of the invested cash of $3M, or 6.8% per year on average. In years 6-10 we pay down a further $1.45M or so, or almost 45% or about 9% per year of the $3M. That is not counting any cash flow and/or likely increase in value as rents, and thus also the value of an asset, on average, rise with inflation. Slowly and steadily you build wealth, a little bit every month, with your three profit centres (as shown in the 3 course meal below).

Where else in the world can you make high single digit to low double digit Return On Investment (ROI) with low risk and almost no work?

This assumes, of course, that you have cash flow to hold the asset. In the example above, selling or refinancing in year 5 is an option, or in year 10 as mortgage discharge penalties are often prohibitively high in commercial (but also residential) mortgages.

Tip 1: Do not sell or refinance without first calculating the mortgage discharge penalty.

Real estate is a transaction-heavy business. So, if you sell, you incur the following fees or costs. You need to keep these costs in mind and then decide if you really want to sell and if the selling price will be profitable to your wallet or not. For instance, in some cases, when a homeowner sells his house for cash to firms like ASAP Cash Offer (which is known to provide cash for houses boston) the value that he gets is often higher than the repair costs he has to bear. So, it might not feel really burdensome post the repairs are done. Anyway, let’s see what costs are incurred before the sale of a house.

a) getting the asset ready for sale, which in the case of a single-family home almost always means a vacancy of several months while you fix the place up (possibly, by opting for basement refinishing, mold damage restoration, and Pest Control). After this, you perhaps stage it and then list it with a competent realtor

b) realtor commission (of 1.5-4% of the asset value depending on location and asset size)

c) legal fees

d) mortgage related fees

e) capital gains or business income taxes on the gain

Tip 2: Do not sell unless you have taken into account all of these five costs, to arrive at true, after-tax cash.

There are also two non-cash costs involved when selling.

First, there is the emotional cost, the agony. When you consider selling, you will wrestle with that decision for months, years sometimes. You know the assets well, you know the area well, you know the onsite manager well in case of an apartment building, you know the numbers and cash flow backwards and forwards. You agonize before the sale and frequently afterwards. 100% of my buildings I have sold over the years are worth more today than when I sold them. Yes, all of them. ?Gee, why did I sell?? I often ask myself.

Then there is a second cost: the work that is required to invest the money somewhere else (more agony). In today?s volatile stock market and low interest rate bond market it is not that easy to find a decent yielding vehicle. Then the money sits there in your bank account doing nothing until you decide, after months of thinking, working, analyzing options, driving or flying around to write offers on other assets, where to place it.

Tip 3: If you do not have a solid asset lined up with much better prospects than the one you own, don?t sell.

Keep in mind that a new asset will likely be smaller, as the cash you receive upon selling is after-tax cash.

So, when should you sell?

There are often personal reasons that might make you decide to sell, like a divorce, the death of a partner, a partnership breakup, life emergencies, illness, or expenses beyond your normal means or what your asset?s cash flow can provide. In other words, you need cash, above your reserves, other incomes or cash flow today. If you need cash in a hurry you will pay dearly for it, in terms of mortgage discharge fees and a lower purchase price in most cases.

Tip 4: Have ample reserves so you do not become a motivated seller.

Another time to sell is when the market is abnormally hot, like we saw in Edmonton in 2007 during the condo conversion craze, the real estate bubble in the US around 2006, or today in Toronto or Vancouver. The value of the asset has no relation to CAP rates, build costs or other metrics like price per square foot. This is usually called a ?bubble? and it does exist from time to time.

Tip 5: Understand the metrics of your market and your asset class so you can distinguish between a bubble and normal market appreciation.

Sometimes you might wish to (or should) sell because of efficiencies or personal location changes. Say you lived in a city and owned a few houses there and self-managed, but you decided to move to another city where self-management of these houses is now difficult and/or a local competent management firm cannot be found. Or perhaps you decide to consolidate your holdings for greater efficiencies and decide to ?prune the garden? by clustering and removing outliers, either geographically or by asset class.

Tip 6: Like a good gardener, prune your holdings from time to time for optimal growth.

The last reason to sell is that you want to switch asset classes, markets, or know other better risk-adjusted return opportunities outside of real estate. Some markets have run their course, and you know there will be a lengthy lull, and if you know other better markets with more upside, then sell, after considering all true sales costs involved. The grass is not always greener elsewhere, but sometimes indeed it is. Some asset classes, such as apartment buildings, tend to be lower risk and thus will be relatively more expensive per $ of cash flow than higher risk asset classes such as office buildings or industrial warehouses. If you truly understand this new asset class and the risks it presents, you can, in many cases, get better returns for quite some time. Everyone talks ROI and returns, but few look at the risk of vacancies or price drops.

Final Tip: Be aware of risks in new asset classes or areas, i.e. understand the difference between grass and green paint!

Many a novice investor jumped over the fence (say to the US or into construction or to another city) to land on hard concrete, painted green, breaking a leg, or worse.

As such, in most cases, holding with the occasional refinance is the better path to take for true systemic wealth creation. Then use that new cash from the refinance for other (allegedly greener) opportunities in a measured pace. In many cases you can hire competent property managers that take care of everything so old age, or death even, is not an excuse to sell. Your grandkids will thank you! And when you get the final cheque, may you truly be ecstatic after a long period of agonizing.

Thomas Beyer is the President of Prestigious Properties, an investment group with holdings in BC, Alberta and Texas exceeding $125M. He is a long term REIN member and the author of the book ?80 Lessons Learned on the Road from $80,000 to $80,000,000?. Reach Thomas at tbeyer@prestprop.com

{{cta(‘5510749d-c854-4e57-a2b1-ca60ac46ede8’)}}