Stabilizing Your Multi-Family Property

By Pierre Paul Turgeon

You have finally purchased your first multi-family and now it is time for you to get to work and launch the process of stabilizing your property.

Stabilizing means maximizing the performance of the property, namely maximizing the net operating income (NOI), reducing operating expenses wherever possible, and improving property condition.

Ideally, when you conducted your due diligence during the purchase process, you should have identified the items requiring stabilizing.

Maximizing Income

Maximizing income is one of the most critical components of stabilizing a property. Remember, the income approach is the main method for valuating apartment buildings, hence the higher the net operating income (or NOI), which is the net income before mortgage payments, the higher the value of the property. In addition, there is a multiplier effect at play here. For each dollar in increased NOI, the property appreciates by as much as $16. As a result, you can build equity super fast!

Accordingly, it is your job as a business owner to make sure your rents are competitive with current market rates at all times in order to ensure your property value is the highest possible.

The stabilization process is particularly important if your due diligence has revealed there is an upside in the rental charges and as a result, you took out a bridge loan to enable you to increase rents, hence increase the value of the property. You will want to refinance the property only when rents have been raised to market average, thereby ensuring you get the maximum loan amount possible.

In the last couple of years, most of my deals have been financed using bridge loans or interim financing. The main reason I opted for this type of financing is precisely because I had the ability to significantly increase rents and therefore increase the NOI and accordingly the value of the property. In one instance, rents were below-market rents by between $50 to $150 per suite and simply by raising them to market, we were able to do an equity take out in the amount of $239,000 within ten months of purchasing the property! This represented a cash on cash ROI of 18.54%! Talk about hitting a home run!

This is the exception, but such great deals can be found from time to time if you look closely. It presupposes that you have done your homework ahead of time and you know whether there is room to increase rents. Had I not known what average market rents were at the onset, I might have missed that deal.

Reducing operating expenses

Now that you understand the name of the game in multi-family properties is to maximize the net operating income in order to maximize property value, the next step in the stabilization process is to look for ways to reduce operating expenses as a means to further increase your NOI. Key operating expenses include:

Property taxes

Insurance

Repairs and maintenance (excluding major capital improvements such as roof, boiler replacement, etc.)

Utilities

Garbage

Snow removal

On-site manager (resident manager)

Property management

Marketing

Miscellaneous

Since you don’t have control over most of these expenses, such as property taxes or insurance, you need to focus your efforts mostly on attempting to reduce utility costs which, depending on the age and construction type of the property, can easily represent anywhere between 10% to 15% of total operating expenses. Utility expense reduction measures may include installing energy-saving LED lighting in hallways and other common areas. You can go even further than this to save money by using energy-saving electricity providers for efficiency. If you’re located in Texas, check out Amigo Energy plans and compare it against other main suppliers on the Home Energy Club website.

In our case, starting last year, we also systematically replace all toilets with low flow toilets using three-litre tanks as opposed to thirteen-litre tanks that many of our older properties still had. We also installed “tenant-tamperproof aerators” on kitchen and bathroom faucets and tamperproof showerheads.

At the same time, many people opt to install water meters, such as those from Flow Meters, into the properties to continually improve water efficiency and monitoring in the building. Not only does this let you keep track of how much water exactly is being used, but it can help you reduce costs by realising what is using the most of this utility in your property. Remember, you not only pay for water coming into the building, but you also pay for wastewater going out into sewers.

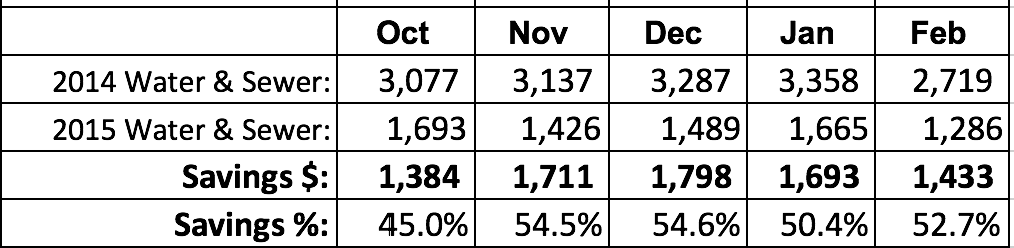

For one of our properties, a 38-unit building with the majority of suites being two-bedroom units with multiple occupants, preliminary comparative analysis year over year seems to indicate we are achieving an average monthly saving of $1,604, or $19,248 annually, as shown in the table below. In other words, our NOI, assuming other expenses remained constant, will likely increase by $19,248. As an illustration of the multiplier effect discussed above, if we apply a 6% cap rate to this saving of $19,248, this translates into an equity creation in excess of $320,800 ($19,248 divided by 6%).

The cost of installing the new low-flow toilets was $12,000 and our payback time was less than a year.

Furthermore, a couple of years ago in the same 38-suiter, we also installed power sub-meters which translated into a 57% saving in our power bills. Previously, there was only one house meter for electricity and accordingly, tenants did not care how much power they consumed and our bills were very high. Once again, we forced an equity creation of over $300,000 simply by installing sub-meters.

Finally, be sure to review your numbers monthly when you get your monthly operating statements from your property manager. I mean every number on every budget line! Figure out averages for your utility costs and monitor them monthly to make sure they’re kept in check and remain within the range of normal average. If there’s a major water leak somewhere in the building, the numbers will tell the story and you are now in a position to promptly address this.

Improving physical condition

As mentioned above, once you take possession of your multi-family property, your due diligence, if properly conducted, and in particular your assessment of the property risk factor (that is the physical condition of the property), should have revealed what improvements and/or upgrades are necessary, if any.

The mandatory improvements will inevitably include those pertaining to the protection of the physical integrity of the property, such as a new roof, and ensuring that all building systems, such as electrical, plumbing, mechanical (boiler, hot water tank, etc.) are operational and serviceable and should have a minimum remaining economic life (REL) of at least five years. Other mandatory repairs would also include anything pertaining to health and safety standards, such as height of balcony railings, fire code compliance, etc.

As part of my due diligence process, I always clearly identify required repairs and if significant enough, I will attempt to reduce the purchase price accordingly and I make sure I have sufficient capital upfront to address these promptly. In cases where the REL of any building system is more than five years, but less than ten, I’ll start building a reserve by putting funds aside each month to deal with it in due course.

Be mindful what improvements you’re spending money on and be sure to calculate the ROI you’re getting on those. My advice to novice multi-family owners is to take the time to ease into their new property and get to know it first. If the repairs are not urgent and absolutely required, i.e. the physical integrity and health and safety are not a concern, then wait for a little. Let me give you a few examples.

Boilers. I have a few properties where the boiler is original from the 60’s and is made of cast iron. The mechanical system of such old boilers is super simple and its maintenance easy. If my plumber tells me the boiler will outlive me, or that its REL exceeds five years, I’d rather spend money on upgrading suites (which would enable me to increase the rents and therefore my NOI) than replacing the boiler with an energy-efficient one. Replacing an operational boiler won’t enable you to charge a higher rent. And believe me, if newer boilers are anything like my new household appliances they seem to be designed to break down after only a few years?

Same thing goes for windows. Sure, the property would look much better with newer windows, but will new windows allow you to more easily rent your units and charge higher rents? Unlikely! So make sure you weigh the pros and cons of each improvement and calculate your ROI and payback time first. If the windows are still functional and there is no water penetration, perhaps you may consider simply recapping them. That’s what many large multi-family landlords such as the REITs do.

General comments on the stabilization period

Each property is unique! Accordingly, the stabilization period for each building will vary. In some instances, it may take months, others years. For example, if you have a poor quality tenant base with hoarders as tenants, or tenants always paying rent in arrears, drug dealers, etc., getting rid of junk tenants may take a while. As a result, you may suffer a loss of income until such tenants are evicted and suites are upgraded.

The point here is that you should not expect much of a cash flow, if any, during the stabilization period. So plan for this! In my case, I want to maximize cash on cash ROI and I choose to re-invest the generated cash flow into gradually improving the property. That’s a personal choice.

Pierre-Paul Turgeon has been involved in real estate investing for over 20 years, initially through the purchase of smaller properties in the Province of Québec such as single homes and duplexes. Contact Pierre-Paul at pturgeon@matterhorninvesting.com

{{cta(‘f0472098-84f6-4c13-bfc9-9753d8037a4d’,’justifycenter’)}}