The 49th Parallel: Stocks vs. Real Estate in North America’s Largest Countries

By David Franklin

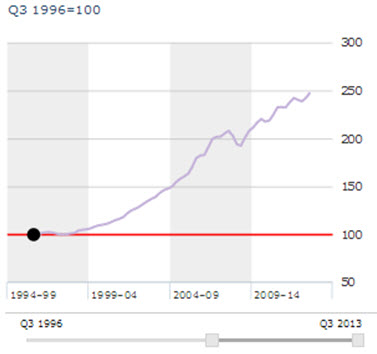

We have all been told by the stock market proponents that you cannot time the market and you have to invest in the stock market for the long term. I know lots of people who invest in stocks and have even looked at a robinhood app review to see if I should start investing but if this is going to be a long term investment like proponents say then I want to do as much research as possible before hand, since I want to find the best stock market app (or gute Brsen App in German) to use when trading. If you bought at the top of the market in 1998 your gain was about 81% but if you bought at the bottom of the market your gain was about 140%, a difference of nearly 60%. If you bought at the top of the market in 2000 your gain was about 28% but if you waited and bought at the bottom of the market in 2002, less than two years later, your gain was about 131%, a difference of about 103%.

If you read the motley fool review, deciding investing was for you, and then bought at the peak of the market in 2008 your loss is 3.5%, but if you waited to buy until 2009, less than one year later, your gain was about 82%, a difference of over 85%. If you bought at the peak in 2011, your loss is about 3%, but in the same year if you bought at the bottom your gain is about 16%, a difference of about 19%.

As you look at the following chart, does it not remind you of a roller coaster?

What the chart demonstrates is that timing is very important. To make money investing in the market you want to buy at the lows and then sell at the high. The question for the average investor is: how do you learn to do this? And the answer is: it is very difficult to learn this and very few investors or even stock market professionals ever do. Why then do the financial planners and investment advisors always advise investing in the stock market? The answer is most of them are licensed by their provincial securities regulators, which only allows them to make money selling securities to you.

They cannot sell you real estate or mortgages and make money by doing this. Further, they would not want their clients buying real estate because the funds for the purchase would either come from their client selling their securities holdings or by not advancing more funds for investment. In either case, the advisor would be earning less income.

Most financial planners do not advise investors to buy specific stocks, but instead recommend investing in the stock market by purchasing mutual funds. Whilst it is important to know that investing in areas such as VISA Aktien (VISA shares) can provide you with a substantial amount of money from the market, going down the route of purchasing mutual funds is also not a bad idea to consider either. It comes down to what works better for you in the long run. By selling a mutual fund they and their firm can make about 5% commission and earn about 1% as an ongoing trailer fee for as long as you own the mutual fund. Investment advisors also do not usually recommend buying specific stocks, but instead advise buying a portfolio and for doing this they charge about 1% of the value and you have to pay the commissions when the securities are purchased and sold.

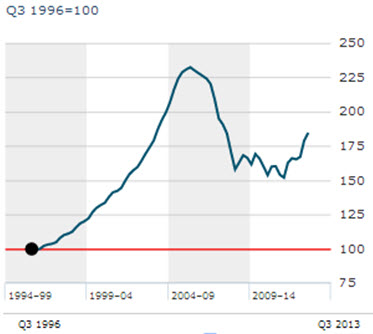

From the third quarter of 1996 the residential real estate has increased nearly 150%. The only major decrease started in late 2007 and ended in 2008, which was about 7%, but then continued upward. As you look at the following chart you can see that there are no major ups and downs as there are in the stock market chart.

If you purchased stocks in the third quarter of 1996 your gain was about 150% and if you bought real estate the gain was about the same, 150%. In addition to this gain, the investor who owns single family residential rental real estate has earned a yearly income. For simplicity, assuming that the real estate investment was all cash and that the income was only 5% a year, the additional return over this 17 year period is 85%, for a total return of 235%.

What may be surprising for Canadians is that the US stock market and residential real estate performed the same way the Canadian markets performed.

If you bought at the top of the market in 1998 the gain was 47% and if you bought at the bottom of the market, also in 1998, the gain was 74%, a difference of 26%.If you bought at the top of the market in 2000 the gain was 28.18% and if you bought at the low of the market in 2002 the gain was 130.78%, a difference of 102.16%. If you bought at the peak of the market in 2007 the gain was 18.62% and if you bought at the low of the market in 2009 the gain was 170.36%, a difference of 151.74%.

From the following chart you can see the same roller coaster ride that the U.S. stock market experienced.

The following chart has the performance of the residential real estate from 1996.

As a knowledgeable real estate investor, when you saw the tide turning in 2006, you could have liquidated your portfolio, as the residential real estate market did not drop overnight and even though you would not have made 290%, you probably could have made 200%.

Compared to the stock market with all of its ups and downs, real estate is boring and that is a good thing.