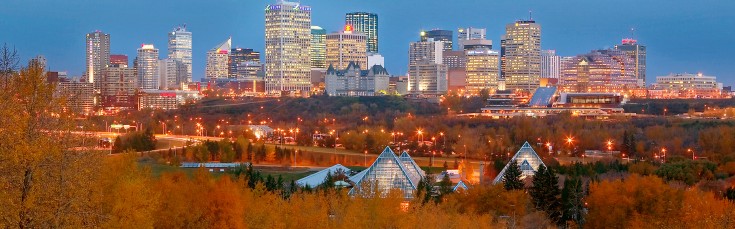

Edmonton in 2013 – Is CMHC’s Forecast Wrong This Time Around?

Excerpt from CMHC Housing Outlook Conference Calgary November 2012

By David Lan

Strong economic conditions, including low mortgage rates, robust job growth, and continued gains in net migration, have contributed to higher housing starts in 2012 in the Edmonton Census Metropolitan Area (CMA). At the same time, lower supply in the competing resale market and declining rental vacancies have prompted some households to look to the new home market to meet their housing needs. Under these conditions, total starts in 2012 are forecast to be 12,000 units, representing an increase of 295 over the previous year. In 2013, total starts are expected to remain elevated yet moderate by 10% to 10,800 units. Economic conditions will remain positive and support new home construction, however modestly higher mortgage rates and reductions in the pace of job growth and net migration will slow demand.

Single detached starts in 2012 are forecast to reach 5,600 units, an increase of 12% from 5,017 units in 2011. In 2013, however, demand for new single detached homes will moderate. While higher levels of employment will continue to bring more potential buyers, competition from the resale market will impact the traffic to builders sales offices, contributing to lower single detached starts. CMHC is forecasting single-detached starts to decrease 2% to 5,500 units in 2013.

Multi-family starts in 2012 are on pace to reach 6,400 units. With the start of many multi-family projects this year, the number of units under construction has also increased. Some of these units will represent additions to inventory when completed and will inhibit construction in 2013. CMHC forecasts multi-family starts to decrease 17% next year to 5,300 units.

The strong growth in full-time employment in 2011 drove demand for existing homes in 2012. MLS® residential sales in Edmonton are on pace to increase 6% in 2012 to 18,000 units. In 2013 moderating full time job creation and modestly higher mortgage rates will result in a slower gain in existing home sales. MLS® residential sales are anticipated to rise 2% in 2013 to 18,400 units.

The average MLS® price in 2012 for the Edmonton region is forecast to increase 2.6% to $334,000. Balanced market conditions are expected to persist for the remainder of this year and into 2013. The average price is expected to reach $341,000, up 2.1%

With the apartment vacancy rate in Edmonton expected to decline, the average two-bedroom rent in October is expected to reach $1,065 in 2012, up from $1,034 in 2011. The upward pressure on average rents will extend into 2013 as a result of low vacancies. CMHC is forecasting the two-bedroom rent in October 2013 to average $1,105 per month.

For the full report, visit: http://www.cmhc-schl.gc.ca/odpub/esub/64343/64343_2012_B02.pdf?fr=1355254658611

David Lan is a Senior Market Analyst with Canada Mortgage and Housing Corporation in the Edmonton Office. He can be reached at dlan@cmhc.ca or (780) 423-8729.

REIN Insights

During a time of economic uncertainty, Edmontons real estate market has continued to provide investors with unparalleled opportunities. In fact, its recent dip (2008 2010) in average sale price and volume proved to be a strong buying opportunity to those who understand long term economic fundamentals. Over the last decade, REIN has consistently ranked the city as not only one of the real estate investment markets in the province, but the entire country and continued to do so during the downturn as our forecasts were based on the underlying economics of the city rather than simply real estate activity.

During a time of economic uncertainty, Edmontons real estate market has continued to provide investors with unparalleled opportunities. In fact, its recent dip (2008 2010) in average sale price and volume proved to be a strong buying opportunity to those who understand long term economic fundamentals. Over the last decade, REIN has consistently ranked the city as not only one of the real estate investment markets in the province, but the entire country and continued to do so during the downturn as our forecasts were based on the underlying economics of the city rather than simply real estate activity.

Earlier this month, REIN released the 2013-2016 edition of the Top Alberta Investment Towns report and ranked Edmonton as the second-best city in Alberta in which to invest in real estate over the next three years, clearly showing our belief that the city will continue to out-perform most Canadian cities for years to come.

While CMHCs housing market forecast for Edmonton in 2013 is primarily positive, the outlook downplays the citys potential for growth in the next few years. The city is an economic powerhouse, recording the fourth-highest GDP growth of all Canadian cities in 2011. With just two weeks left in the year, its safe to say that Edmonton will once again be declared one of the countrys economic leaders in 2012. A phenomenal $196+ billion in major capital projects are planned for the Edmonton region over the next five years and this in a region with only 1,000,000 people; meaning that job and population growth is poised to be strong for many years to come.

This influx of people moving to Edmonton looking for work will continue to fuel the demand for both rental and ownership properties. The citys increasing average wages means we can expect an increase in consumer spending, which will stimulate the economy and in turn create even more jobs. This economic cycle is one that many strategic industrial, residential and commercial investors have begun to understand and take advantage of. Strong migration flows will continue to support rental demand in the city, as the majority of people who move to a new region tend to rent for two to three years before purchasing their own property. The Edmonton CMA recorded an official CMHC vacancy rate of 2.7% in the spring of 2012, an extremely low rate when you factor in the amount of vacant units left that would be considered quality rental units by potential tenants. The vacancy rate is expected to drop even further in 2013, putting an upward pressure on the average rent.

CMHCs outlook pegged the average rent for a two-bedroom unit in Edmonton at $1,065 in October 2012 a rent that our active Edmonton REIN investors told they were already achieving months before. One downside to CMHCs data is the organizations use of purpose-built rental units (which typically command less rent than privately rented units) to measure average rents. While CMHCs numbers provide investors with a good starting point, their conclusions are often lower than actual on-the-street prices. Further, rents in the city move monthly, so relying on a report that comes out annually will not provide investors with an accurate picture of the current residential market. It does provide a good comparison to other cities CMHC tracks or as a longitudinal examination over time. Diligent investors will also look at rental rates posted in local newspapers and rental websites for the latest market statistics for the month they are looking to re-rent their units. This is going to be especially important in 2013 as upward rent pressure will be strong and prices will move more quickly than we have seen in the last four years.

The average price of a home in Edmonton is forecast by CMHC to increase by 2.6% next year. According to them, Edmonton should record an average price of $334,000 by the end of 2013 – a moderate growth, and one that will see the city keep its title as one of the most affordable markets in Canada. REIN believes that CMHCs average increase will be lower than what the market bears.

RBCs Affordability Index shows that 31.1% of a median pre-tax income is needed to service the average cost of mortgage payments (principal and interest), property taxes, and utilities on a detached bungalow in Edmonton. Compare this to any other metropolitan centre in Canada, and Edmonton is the most affordable market in the country (including Saskatchewan and the Maritimes). In fact, todays market is more affordable than the citys 27-year average (calculated from 1985 to today) of 33.5%. Rapidly increasing average weekly earnings and rock-bottom mortgage rates have created the perfect storm for property investors: home prices that are high enough to prevent some people from entering the homeownership market, but not high enough to prevent decent cash flow for the property investor.

Remember to do all your homework when researching cash flowing properties in Edmonton. The diligent investor purchases properties in areas that are poised to see price increases from planned transportation improvements.

Allyssa Epp is a Research Analyst for The Real Estate Investment Network