Real Estate Mythbusters: What are Cap Rates?

When it comes to determining the value of real estate assets there are three basic approaches used: the Cost approach (often referred to as the replacement cost approach), the Sales Comparison and the Income Approach.

Cap rates are used within the Income Approach to convert the anticipated net annual income stream into an indication of the capital value of the property. Hence, this method is also referred to as the income capitalization approach. The basic theory of the Income Approach to value is that:

the value of a given property is the present worth of all the net income that the property will produce for each year of its remaining useful life.

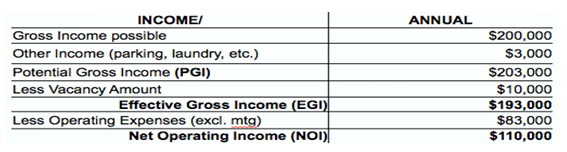

It goes without saying that in order to use the income capitalization approach, the first step is todetermine what is the income of the property or net operating income (NOI). This is the propertysincome before financing costs or mortgage payments. Its critical to accurately verify the NOI with utmost accuracy. The basic steps to follow in the Income Approach are detailed as follows:

- Estimate the total annual gross income that the property is capable of producing less allowances for future vacancies and bad debts.

- Estimate the total annual operating expenses.

- Calculate the net annual operating income (see table below).

- Apply the market cap rate to the property

You will note that valuation methods are called approaches. The point here is that valuation is notan exact science by any means. These methods are approximations of value only and no more; however, you can be sure that the banks and Canadian Mortgage & Housing Corp (CMHC) will rely heavily on the income capitalization in determining the value of your property.

How to calculate the Cap rate?

In the example in the table above, we know the property generates an annual NOI of $110,000. In order to calculate this propertys cap rate, the next step is to divide this NOI by the sales price for this property which, in this case, well assume is $1.7 million:

In other words, the NOI of $110,000 represents 6.47% of the capital value of $1.7 million. Another way of looking at this would be to say that this property provides a return, or yield of 6.47% NOI of its purchase price before mortgage payments.

Keep in mind, this is this propertys specific cap rate and if we want to know the market value of this property, we now need to apply a market-derived cap rate to this propertys NOI.

The market-derived cap rate is simply the average cap rate for comparable properties that have recently sold in the market place using the formula above. For example, if the average market- derived cap rate is 6% and we apply it to the NOI of $110,000 we now get a market value of $1,833,333. High cap rates mean low value and conversely, a low cap rates translate into higher value.

Accordingly, an investor must be very familiar with the average market cap rates in any given market and monitor the market cap rates on an on-going basis.

Other things you need to know about cap rates:

Cap rates may also serve as indicators for a few things:

- Market risk or a property condition risk: A savvy investor will want to be compensated for taking on a higher risk by paying less for the property; hence, buying the property at a higher cap rate;

- Demand: A high demand for properties in any given market will tend to compress cap rates downward; whereas, low demand may have the opposite effect;

- Propertys performance: Compare your propertys cap rate to the average and gauge your propertys performance. Is it within the range of current market cap rate for comparable properties? If not, find out why and explain discrepancies.

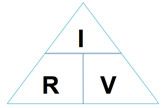

Here is a little trick to calculate either the cap rate or the value of the property. In both cases; however, you need to know the NOI. Then, if you divide the NOI (I) by the cap rate youll get the propertys value. If you divide the NOI by the purchase price (V), youll get the cap rate.

R = Cap rate

V = Value / Purchase Price

Bits of wisdom

- Verify each number in the income and expenses. Numbers must be reliable Let the numbers tell you the story, not your emotions.

- Dont get hung up on cap rates. Make sure you have a positive cash flow after mortgage payments.

From 2006 to 2010, Pierre-Paul Turgeon was an underwriter of multi-family properties at Canada Mortgage and Housing Corporation (CMHC), where he worked since 1996. Pierre-Paul is also a lawyer and member in good standing of the Law Society of Upper Canada (Ontario). Pierre-Paul is now the owner of Matterhorn Real Estate Investments Ltd. whose mission is to take advantage of the investment opportunities in Alberta real estate by purchasing income-generating multi-family rental properties.

From 2006 to 2010, Pierre-Paul Turgeon was an underwriter of multi-family properties at Canada Mortgage and Housing Corporation (CMHC), where he worked since 1996. Pierre-Paul is also a lawyer and member in good standing of the Law Society of Upper Canada (Ontario). Pierre-Paul is now the owner of Matterhorn Real Estate Investments Ltd. whose mission is to take advantage of the investment opportunities in Alberta real estate by purchasing income-generating multi-family rental properties.