Empirical Proof That Transit Protects or Enhances Your Property Values

By Melanie Reuter

As population increases and a new demographic enters the housing market, there is a growing interest in development around transit nodes. For example, you’ll notice that in certain groups such as burnaby homes for sale, those that are closest to the best transport links can demand the best prices. To address quality of life issues connected to traffic congestion, pollution and the rising costs of commuting by vehicle, city planners are encouraging densification around LRT stations in particular.

Increasingly, stakeholders are realizing the value of locating at transit nodes. According to research recently published in the US, residential properties maintained their value during the recession, so much so that the sale and purchase of the properties and the rush to relocate (perhaps with the help of round rock movers) did not change. However, compared to this, other properties plummeted in value. Commercial real estate experiences an even greater premium than residential real estate. As evidenced all over North America, consumers are willing to pay more to live in areas that are walkable, accessible to transit and have a mix of residential and commercial and employment opportunities.

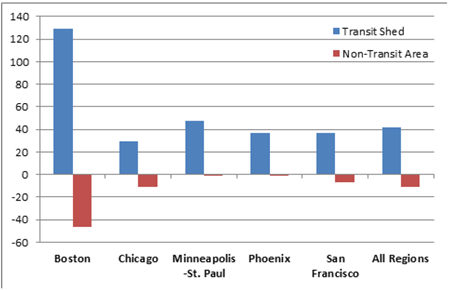

Recent research conducted in five major regions in the US demonstrated exceptional findings: properties located within the vicinity serviced by fixed guideway transit (Light Rapid Transit (LRT) such as Vancouver’s SkyTrain or heavy and commuter rail, such as the WestCoast Express) outperformed the region as a whole by 41.6%. If values dropped across the board, as evidenced in almost all communities in the US, those properties within the ‘transit-shed’ experienced a smaller drop.

Figure 1. Percent Change in Average Residential Sales Prices Relative to Region, 2006-2011

Source: American Public Transportation Association, 2013

The premiums realized for different asset classes range tremendously. In the US, the variation for residential properties was:

_________________________________

American Public Transportation and The National Association of Realtors. (March 2013). The New Real Estate Mantra: Location Near Public Transportation. http://www.apta.com/resources/statistics/Documents/NewRealEstateMantra.pdf

- Single Family Residences – 2-32%

- Condos – 2-18%

- Apartments – 0-45%

In Phoenix, AZ, apartment buildings located near transit had the smallest decline in average sales price. So although not completely immune to the recession, this asset class in Phoenix had a buffer and was negatively impacted less. In Boston, apartment buildings with more than eight units had the largest increase in value; condos also saw an increase to a lesser degree but all properties located near transit at the very least held their value compared to similar properties outside of the transit-serviced area. However, in San Francisco, larger multi-family buildings slightly declined in value in the transit shed but increased slightly outside of it. Small multi-families, single family homes, and condos, however, increased more in value.

Property Resiliency is Higher in LRT Served Areas

As reported in our previous research , the type of transit played a major role in real estate premiums. The effects of regular buses and Bus Rapid Transit (BRT) were not realized to the extent that premiums were seen at properties around LRT. This was believed to be linked to the non-permanence of non-fixed guideways – routes could easily change mitigating the positive effects of access to transit. More recent research from APTA demonstrates that it was the frequency of the fixed-rail transit that had the most impact. The more connected and the higher frequency of service, the higher the value was placed on the real estate connected to the transit service. This is demonstrated in BC when examining the values around properties located near the WestCoast Express (a commuter line with trips westward in the morning only and eastward only in the evening). Although there would definitely be an impact on values according to research, it is not as pronounced as it would be if this commuter line ran as constantly as LRT such as SkyTrain. This is evident in research conducted in Boston , which indicates the highest impact is from Rapid Transit, followed by Bus Rapid Transit and to a lesser degree, Commuter Rail.

APTA’s research on US cities found that in addition to being located near light rail stations, the premium increased if the following features were also part of the combination: a connective street network (that is through streets, grids versus cul-de-sac and organic street layout); smaller blocks; walkability to commercial services; and mixed land use (retail, service, residential) .

_________________________________

The Real Estate Investment Network (2013). http://myreinspace.com/downloads/research_reports/m/research_reports/137356.aspx

American Public Transportation and The National Association of Realtors. (March 2013). The New Real Estate Mantra: Location Near Public Transportation. http://www.apta.com/resources/statistics/Documents/NewRealEstateMantra.pdf

Ibid.

Figure 2. Percent Change in Average Residential Sales Prices Relative to the Region in Boston, 2006-2011.

Source: American Public Transportation Association, 2013

Premiums of 150

Through tax incentives and density bonusing, the commercial sector is not only benefitting financially by taking advantage of Transit Oriented Development (TOD), but is also attracting exceptionally talented employees who can afford to pick and choose employers. Businesses are attracted to world class areas that are comprised of the exceptional ability to move their goods, and their people, in and out with ease. Employees are attracted to businesses that reflect their values, in this case ease of travelling to and from work, saving money on housing and commuting, and in some cases, a lighter impact on the environment by utilizing transit to and from work. They want to know that they have chosen a company that aligns with their values, including promoting a healthy team environment, so they may be interested in team building for work retreats, as well as regular meetings to ensure that they feel part of the core of the business.

Overall in the US, research found that office and retail space experienced the best premium of all types of asset classes with values approximately 150% higher than the same properties located outside of the LRT reach . Although findings were not as robust in Metro Vancouver specifically, a synopsis of findings by Jones Lang LaSalle showed that indeed, commercial real estate located adjacent or close to LRT nodes commanded higher rents and had higher values.

Rapid transit expansion and redevelopment of the immediate vicinity around the stations is resulting in a de-emphasis on head office location in downtown Vancouver. As costs of square footage remain high

_________________________________

Ibid. Jones Lang LaSalle (April 2013). Rapid Transit Index (RTI) Q1 2013. http://www.udi.bc.ca/sites/default/files/events/udi/presentations/Vancouver_RTI_Q1_2013.pdf

and Transit Oriented Development (TOD) takes hold across Metro Vancouver, commercial tenants are considering and choosing to relocate or open at SkyTrain stations across the Metro region.

In areas within 500 metres of a station, the vacancy rate has dropped to 4.9% from 6.5% the previous year (omitting the newly completed 225,405 square foot Brewery District Building that is entirely vacant). Comparatively, even if one were to include the Brewery District (making the vacancy rate 7.7%), in areas outside of the 500 metres but still considered serviced by transit (that is walkable) the vacancy rate is 11.7%. Rental rates are also 21.8% lower than buildings within 500 metres.

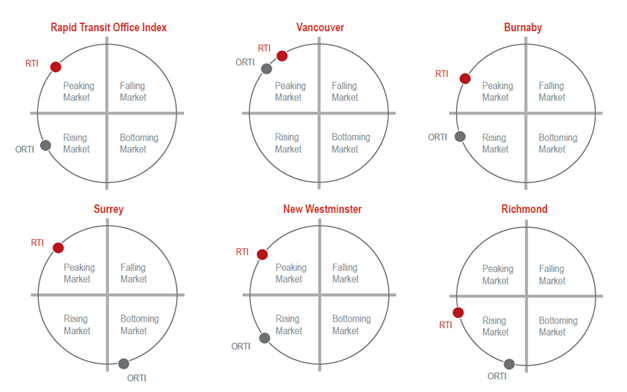

Jones Lang LaSalle’s market overview provides an outlook of the direction of rapid transit serviced commercial real estate. The chart below outlines whether the market is peaking, rising, falling or bottoming.

Figure 1. Cycle of Commercial Real Estate at SkyTrain Stations in each City (First Quarter, 2013).

Source: Jones Lang LaSalle 2013

Vancouver

Property around the Vancouver SkyTrain Stations (outside of the downtown) have a vacancy rate of 5% in the first quarter of 2013, with a rent premium of 21.5% for spaces within 500 metres of a station compared to those outside it but still serviced by SkyTrain.

With the relocation of Vancouver Coastal Health Authority to Willingdon Ave. in Burnaby, HSBC moved in to occupy 173,000 square foot Broadway Tech Centre at the Renfrew Station. Columbia College will move into the 135,000 square foot space near the Main Street-Science World Station when completed this year.

Fraser Health Authority consolidated their locations into a 160,000 square feet space two blocks from the Brentwood Town Centre Station. This move is almost entirely responsible for the 7% vacancy decline (to 5.4%). Rental asking rates within 500 metres of the stations are 20% more than asking rates outside of the 500 metres.

Mixed use projects at the Brentwood Town Centre Station are underway. SOLO is a four-phase mixed commercial and residential development that will provide 1,400 new homes targeting a younger demographic and urban professionals. Shape Properties is redeveloping 1.2 million square feet of retail space.

The construction of 411,000 square feet of Metrotower III at the Metrotown station has begun with a pre-lease to Stantec upon completion in 2014.

King George Station

Surrey has the lowest vacancy rate of all the TODs in Metro Vancouver. The 2.2% rate is due to vacancies in the Station Tower. The rental asking rate for A class space within 500 metres is 33.4% higher ($24.76 a square foot) than areas still

_________________________________

Commercial properties are generally described as ‘A’, ‘B’, or ‘C’ class defined as:

‘A’ Class: High quality, well designed, using above-average materials, workmanship, and finish; sought by investors and prestigious tenants; excellently maintained and very well managed, especially if the building is more than 10 years old. Attractive and efficient, these buildings are the most desirable in their markets.

‘B’ Class: Offers useful space without special attractions. Has functional layout and design, though not unique. Average to good maintenance and management. Typically 10 to 50 years old.

‘C’ Class: Typically an older building that offers space without amenities. Average to below-average maintenance and management, average to poor mechanical, electrical, ventilation systems. Will likely need a plumber, electrician, and commercial roofing company in Calgary to make repairs before tenants are able to move in. Attracts moderate- to low-income tenants who need affordable space.

serviced by SkyTrain but outside of the immediate vicinity. Jones Lang LaSalle reports that these properties in Surrey are $0.05 higher per square foot than similar properties in Burnaby. Pro-business tax incentives put forth by the city of Surrey, coupled with more affordable residential real estate and larger homes/properties, entice businesses to locate in Surrey over other areas. Access to transit, as well as appealing real estate, enable businesses to attract top employees.

Coast Capital Savings is locating their head office in PCI Group’s mixed-use development at King George Station in Downtown Surrey upon its completion at the end of 2015.

New Westminster

Sapperton Station

Translink is moving its head office from MetroTower in Burnaby to the Brewery District in 2013. The completion of the Brewery District space has resulted in the ‘high’ vacancy rate (28.2%) compared to 4.2% vacancy if the building was omitted. The average asking rates for properties serviced by but outside of the immediate SkyTrain vicinity were higher than properties in the immediate SkyTrain vicinity. This was due to most ‘A’ class buildings being located away from SkyTrain stations. Currently, the asking rates have increased by 13.0% from the previous year due to the newly constructed properties located adjacent to the SkyTrain. Conversely, properties outside of the scope have declined by 6.3% in the same period.

Richmond

With the lowest vacancy rate of all ‘A’ Class Skytrain serviced properties in the Lower Mainland,  the overall vacancy has increased 2.9% due to the unoccupied ‘B’ and ‘C’ class properties. Vacancy of ‘A’ class properties is ten times higher in properties outside of SkyTrain’s immediate vicinity. Overall, along the Canada Line, ‘A’ Class properties are outperforming at the stations, yet other properties are on par or sub-par compared to those outside of the immediate area.

the overall vacancy has increased 2.9% due to the unoccupied ‘B’ and ‘C’ class properties. Vacancy of ‘A’ class properties is ten times higher in properties outside of SkyTrain’s immediate vicinity. Overall, along the Canada Line, ‘A’ Class properties are outperforming at the stations, yet other properties are on par or sub-par compared to those outside of the immediate area.

It’s Hard to Go Wrong with Property in LRT Nodes

Property owners see the multi-faceted benefits of purchasing in these locations for themselves or their tenants: increased access to jobs; a decrease in commuting costs; increased values and rents; and a higher quality of life as measured by connectedness and community. The quantitative data indicate higher values for both residential and commercial real estate around transit serviced areas; the properties also demonstrate resiliency during economic downturns. For commercial businesses, the closer to the LRT station the better (especially with retail businesses); wherein, residential properties generally benefit from being at least 50 metres away from a station but within ‘walking distance’ (which is generally characterized as 800 metres or ½ mile; however, the positive reach seems to be expanding). These factors inform policy and planning decisions for municipal and regional governments and the success of real estate around LRT stations makes it easy for planners to focus attention around transit nodes. We will continue to see substantial density and development in these areas and commercial and residential real estate investors can capture the benefits inherent with the strategic locations of these properties.

Melanie Reuter is the Director of Research with REIN Canada, a real estate research and education company that has been serving investors across Canada for 21 years. She has a Master of Arts Degree from California State University, San Bernardino and a BA from Simon Fraser University in Burnaby, BC. Melanie is envious of the students who now have more money for beer than she ever did going to school because they can take advantage of lower living expenses since the Millennium and Canada Line SkyTrain expansions.

Melanie Reuter is the Director of Research with REIN Canada, a real estate research and education company that has been serving investors across Canada for 21 years. She has a Master of Arts Degree from California State University, San Bernardino and a BA from Simon Fraser University in Burnaby, BC. Melanie is envious of the students who now have more money for beer than she ever did going to school because they can take advantage of lower living expenses since the Millennium and Canada Line SkyTrain expansions.