What Does It Take To Become The #1 Investment City In All Of Ontario?

Hamilton – the place to be for real estate investors in Ontario and across the country.

Infrastructure

Infrastructure is one of the key elements in guiding the decision of real estate investors on where to invest. As a component that can create growth or stifle it in it absence, it is important to examine an area s ability to handle its current population, as well as future growth. Hamilton s existing infrastructure creates an attractive place for business investment. The Hamilton Port Authority is the largest Canadian port with multipurpose facilities on the Great Lakes.

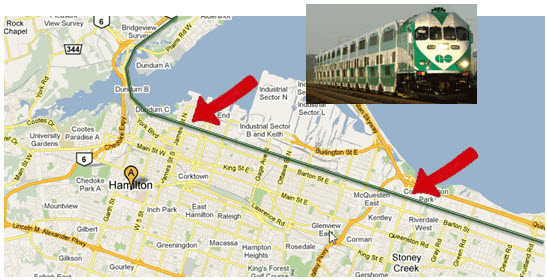

To the south, Hamilton International Airport operates 24/7, is the number three cargo airport in Canada and a good alternative to Toronto s Pearson International Airport. The Opening of the Red Hill Valley Parkway in 2007 completed Hamilton s network of existing highways: QEW, Highway 403, Highway 6, and Lincoln Alexander Parkway vastly improved the movement of people and goods and directly lead to the massive employment growth in the Red Hill Business Park. The railway system is well integrated and networked in the industrial areas and new, full service GO Transit Train stations are expected in 2015 at James Street North near Murray Street and Centennial Parkway near the QEW. The former is expected prior to the Pan Am Games.

Jobs, Jobs and Jobs

The current and future employment picture is quite positive as Hamilton CMA s unemployment rate in March 2013 was 6.1%, ahead of Kitchener Waterloo Cambridge (KWC) (7.2%), Barrie (7.3%), Toronto (8.4%) and the Ontario average (7.7%) .

While this may be news to those new to Hamilton, it is no longer just a steel town ; a diverse employment base is its new economic strength. The Conference Board of Canada s Diversity Index, which calculates how diverse the economic structure of a city is (one being highly diverse and zero being not diverse), gave Hamilton a strong 0.92 rating.

The emerging employment sector is just as diverse: the new McMaster downtown Health Campus will employ 450, who will serve both 15,000 Hamiltonian patients and 4,000 McMaster students; Maple Leaf Foods located in the Red Hill Business Park, is continuing construction of its $395 million facility to bring 670 jobs to the East Hamilton Mountain right next to Canada Bread, who recently opened their doors to employ over 300 people. Within the McMaster Innovation District, McMaster Automotive Resource is set to open soon and employ 120-150 people who will research and develop green automotive technology and work closely with Canadian Material Lab (CanMet), Canada s largest research centre dedicated to metal fabrication which opened in 2011 and employs over 100 people .

Top Areas for Investment

The economic fundamentals of Hamilton on a macro scale are excellent; however, upon drilling down several specific areas emerge as locations on which to focus investment activity. Follow the fundamentals, they will help guide you.

West Harbour

With a new GO Station on James Street North and the McMaster Innovation Park expansion, coupled with the affordability of the area, the fundamentals guide investors to the West Harbour (West of James St North, North of York Blvd). The West Harbour is also home to the Waterfront Trail, Bayfront Park and Pier 4 which make up the nicest lakefront area in Hamilton. Combine that with the growing, transplanted arts scene from Queen West in Toronto to James Street North, you have a very affordable, in demand area for younger Hamiltonians. This area was where the blue collar employees of the steel mills built their homes so houses and lots are small; hence, the typical home investors target is a two-storey brick house, three bedrooms, one bathroom ranging from $220,000 – $240,000 with rents fetching $1,350 $1,450 a month.

Hamilton Mountain (plus Stoney Creek and Binbrook)

The giant suburb of Hamilton Mountain is where most families want to live and is the biggest beneficiary of the Red Hill Valley Parkway and the major employers located in the Red Hill Business Park. If you want relatively safe, boring investing, the Mountain is right for you. Properties here are in heavy demand from both buyers and renters. There are no bidding wars that you read about in Toronto; however, if a house is move-in-ready, expect multiple offers. Great strategies that work here include: single family, detached or semi-detached, rent-to-own, and in-law suites. With in-law suites, investors can charge a $150-$200/month premium to a three generation family (e.g.: grandparents, parents, kids) and the tenants still pay the utilities. Houses cost between $250,000-$290,000 and rent for $1,500 1,900 plus utilities. I do not recommend townhouse condominiums, but prefer freehold.

McMaster University

Student investing is a personal favourite of mine because the yields and tenant profile are probably the best in Hamilton. Demand for housing near McMaster is the highest I have seen (as an investor myself, I own Brock and Laurier student rentals). All of my clients signed 12-month leases with groups of students and several were signed in December for a May 1st move-in. Because demand is so strong, investors have the opportunity to choose their tenants and I recommend you choose students who are enrolled in the more challenging programs, the ones that require marks in the 80 s or higher. The more studious tenants will be too busy studying to party! I have one client who rents her basement unit to three Divinity post-graduate students. One is going to be a chaplain, another a pastor; these tenants probably feel that they have more than one landlord

McMaster is starting construction on the Wilson Building for Studies in Humanities and Social Sciences which will enable the school to grow by 1,275 students – Adding that many students to the area will cause an increase in demand for housing. Generally, I target the areas south and west of the university buying in the $340,000-$360,000 range and renting out houses for $3,000 inclusive per month.

Downtown

The areas around the gentrifying downtown are prime for investing. You only have to take a drive around Bay St. and Main St. to see the cranes in the sky constructing a new hotel, condominiums and the McMaster Downtown Health campus. Downtown also has many amenities: bars; shopping; Hamilton s best restaurants; Farmer s Market; a newly renovated library; GO and VIA Stations; and an HSR bus terminal. Downtown businesses also employ over 24,000 people. When investing here, look to the surrounding neighbourhoods: Corktown, Stinson. Anything west of downtown is more ideal but less

Potential Landmines

In the past two years, there has been increased scrutiny of rental properties by City of Hamilton by-law officers and many investors who own non-conforming, multi-family properties now face legal issues with the city over their current use. The city is ordering investors to convert triplexes back to single family, fourplexes to duplexes (or whatever the legal use is), and investors are losing rents, paying for significant renovations or selling at a loss. Be cautious and smart: do not become one of these investors, buy only what is legal.

The multifamily market is a complete sellers market. Legal multifamily properties, if priced fairly, receive multiple offers. Four to seven offers is common; hence, yields are being squeezed. Combine that with the age (in and around 100 years old), and deferred maintenance issues that require major capital expenditures such as leaky foundations, original windows, decrepit fire escapes, and ancient boilers and you may not see a decent yield. Many landlords in Hamilton are absentee or they defer maintenance and its costs to increase their cash flow; costs, which upon selling, are passed on to the new buyer.

Suiting a basement is not as easy as it is in Toronto, Brampton and the Durham Region. In Hamilton, the process to legally suite a basement starts with a minor variance and architectural drawings so at the outset investors are suffering over $4,000 in paperwork costs and months of red tape. And subsequently, can still very well be turned down. Because of this, my preference is to buy and rent out houses with an existing in-law suite.

Like any city, Hamilton has several unsavory areas. If you follow the fundamentals, know your tenant profile and your investing style, you re setting yourself up for a happier Hamilton investing career. Just like there are great properties in not great areas, there are also bad properties in great areas. Let the numbers guide you.

Erwin Szeto, aka Mr. Hamilton, is a REINTM Ambassador, and Real Estate Sales Representative in Hamilton. Erwin has been investing in real estate since 2006 and is living, investing and working in Hamilton, Ontario.

Erwin Szeto, aka Mr. Hamilton, is a REINTM Ambassador, and Real Estate Sales Representative in Hamilton. Erwin has been investing in real estate since 2006 and is living, investing and working in Hamilton, Ontario.

He is a Business School graduate from the Richard Ivey School of Business from the University of Western Ontario and he enjoys reading books on business and real estate.

StatsCan Labour force characteristics, seasonally adjusted, by census metropolitan area (3 month moving average)

Hamilton Economic Development Department

http://www.thespec.com/news/local/article/551605–mac-s-wilson-building-gets-big-boost