REIN Report: Canada’s Major Housing Markets are Slumping—Except One

Months into the pandemic, investors find themselves in greater uncertainty as real estate markets begin to plunge. This is consistent with findings of the Real Estate Investment Network’s (REIN) Real Estate Cycle Update: COVID-19 Special Report – May 2020 where we looked at provincial real estate market outlooks for the first time ever.

According to the report, all major real estate markets in British Columbia, Alberta, and Ontario are on a steady decline due to the economic impact of the pandemic shutdown and restriction measures—except for one: Ottawa.

These findings are based on many REIN research methodologies including REIN’s Long-Term Real Estate Success Formula and REIN’s Real Estate Cycle Scorecard, both of which evaluate rapidly-evolving changes of economic fundamentals affecting the real estate market, such as GDP, jobs, and population. The report further suggests the impact of COVID-19 on these driving indicators will move markets further into the slump phase in the coming months despite provinces gradually re-opening their economies.

For the first time ever, REIN produced the real estate cycles for three provinces: British Columbia, Alberta, and Ontario. REIN also researched five major real estate markets—Vancouver, Calgary, Edmonton, Toronto and Ottawa—and included the final data for those markets in our Real Estate Cycle Update: COVID-19 Special Edition.

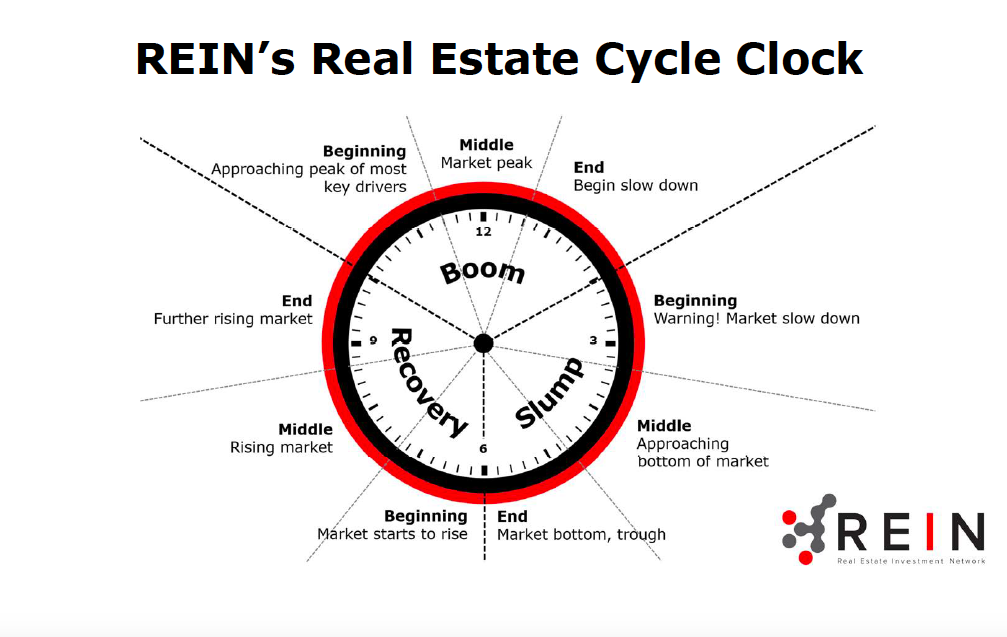

The real estate cycle is an irregular but recurrent and predictable succession of causes and effects that the property market experiences with resultant impacts on the creation and destruction of real estate wealth. It functions as a predictive tool to determine which phase a specific market is currently in based on driving indicators and market influencers. You can think of it as a clock divided into sections reflective of the phases through which the real estate market cycles through.

The slump is a definitive phase of the real estate cycle. During this phase, strategies for real estate investors become limited. For example, in the beginning of a slump, employing tactics such as lease-to-own becomes a tricky proposition; fix-and-flip should totally be avoided, while buy-and-hold is only plausible under certain conditions. But while this phase is generally characterized as market slowdown, it can also be an excellent time for uniquely positioned investors to take advantage of opportunities that are bound to hit the market as we move forward in the real estate cycle.

Interestingly, Ottawa emerges in the beginning to middle of the boom phase, based on the report, despite other major markets declining. This is partly because Ottawa is the seat of Canada’s federal government and is therefore insulated to some extent from the massive pandemic-related joblessness impacting the country. Early in the year, the job growth in Ottawa was at an all-time high as government and high-tech industries posted record growth. This trend acted as a buffer to Ottawa’s economy and real estate, placing it in a unique position among the major markets in the country.

Now, the market forces driving the pace of the real estate cycle are definitely out of our control. But one thing we can control is the way we respond—employing exactly the kind of “pandemic pivot” we need to protect our property during these turbulent times. Moving forward, the key is to watch for indications of recovery such as economic activity, employment, immigration, and new rental demand.

You may access a free copy of the report here.