Why Now May Be the Best Time to Refinance in Canadian History

By Calum Ross

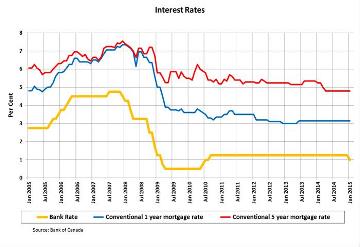

After the winter that seemed like it would never end, spring is finally here! Spring is the perfect time to enjoy the outdoors, spring clean (sorry, I couldn’t resist!) and of course, buy real estate. The first shots have already been fired in what seems to have become a yearly tradition. Two of the big banks, TD and BMO, lowered interest rates on their 5-year fixed mortgages to a record low of 2.79 percent. When the big banks, whowhich are notoriously stingy with their posted rates, are offering mortgage rates this low, it has to be a good sign! If this is a sign of things to come, it looks like this year could be another record-breaking spring housing market, but certainly it will be a near lifetime low for interest rates.

With record-low mortgage rates, there’s never been a better time to consider refinancing your mortgage. And this isn’t just in Canada, people are applying for things like a va cash out refinance in the US too because they’re currently in a great position to refinance. With this being said, right now is perhaps the single best time to refinance your mortgage in Canadian history. Anyone who’swhose mortgage rate is 2.35% on variable rate,rate or above 3 percent on a fixed rate should seriously consider refinancing their mortgage. Here are three good reasons to consider refinancing your mortgage:

- Lower Mortgage Rates

Mortgages may be at a record –low today, but if you locked –in to a 5-year fixed rate mortgage three or four years ago, you might not be so lucky. Your mortgage is most likely the largest debt of your lifetime.; Llowering your mortgage rate can pay big dividends especially when refinancing and borrowing to invest. When you refinance your mortgage, you pay off your current mortgage and take out a new one. Refinancing only makes sense if you’ll save more money than the mortgage penalty you’ll have to pay (more on that below) . or if the money you are taking out can be put to a better use. Before you break your mortgage, speak with your lender to find out what the penalty will be.

2. Putting Your Home’s Equity to Work

With home prices going up, there’s never been a better time to tap into the equity in your home. Whether you’re looking to buy more real estate or , help fund your retirement, refinancing your mortgage can be your golden ticket and you can find out more information by contacting a company that deals with equity release, for example you could visit the The Equity Release Experts or other equity finance companies to see what sum of money you could have released at your disposal. A secured loan is typically the lowest cost of borrowing you will ever have. If you take out an unsecured line of credit, loan, or charge it on your credit card, it can end up being costly. If you find yourself house rich, but cash poor, refinancing your mortgage will let you have your cake and eat it, too. You can hold onto your house and borrow money at ridiculously low interest rates. When you refinance your mortgage, you can tap into up to 80 percent of your home’s appraised value.

3. Debt Consolidation

Did you take out a payday loan you’ve been unable to pay back? Have you needed the help from the national payday loan relief company for a while now? Are you looking for a way to get out of debt that doesn’t mean you’ll have to sell any of your assets? Do you have higher interest debt, negative cash flowing real estate, or a large monthly debt payment crunching your budget? Before you throw in the towel and sell your house, there may be a better option. Debt consolidation offers the best of both worlds: solve your personal debt situation and hold onto your home — it’s a win-win situation! With debt consolidation, you roll all your existing debt into a single loan at a substantially lower interest rate. Many people opt to go for online installment loans for this purpose, but there are other options on the market. Plus, paying 3 percent sure beats the heck out of 18 percent or higher charged by credit cards! When you consolidate debt, your new mortgage pays off all your existing debts. Basically, you start with a clean slate.

4. Mortgage Penalties

If you have a closed mortgage like most Canadians, you’ll have to pay a mortgage penalty to escape the shackles of your bank. If you have a variable rate mortgage it’s pretty straightforward: three months interest. If you have a fixed rate mortgage, you’ll pay the greater of three months interest or the Interest Rate Differential (IRD). If you’ve ever heard the mortgage horror stories of homeowners paying $10,000 or more in mortgage penalties, it’s because of the IRD. Take the time to sit down with your mortgage broker and do the math to make sure refinancing your mortgage makes sense. The fact is many penalties can become a tax deduction when borrowing and some good financial planning along with a good team can make this extraordinary period a great thing for your longer term net worth.

Calum Ross was ranked as the top producing mortgage broker in the country by Canadian Mortgage Professional Magazine. He holds both a B.Comm and MBA in Finance and recently completed a comprehensive Leadership Program at Harvard Business School. Reach him at: www.calumross.com.

{{cta(‘a2f69965-cbaf-4089-8592-d93ceeef8740’)}}