Top 5 Things to Look For on a Tenant Credit Report

*This post is sponsored by one of The Real Estate Investment Network’s Trusted Partners, SingleKey. To become a contributing editor or to learn about our sponsorship opportunities, please contact us at david@reincanada.com.

Being a landlord in today’s rental market requires the highest level of due diligence to avoid leasing your unit to a potentially risky tenant. This is why many landlords will run a credit check as part of their tenant screening process. While these checks are very insightful, it is easy to overlook important information.

SingleKey offers a great way for landlords to screen tenants via our Tenant Credit & Background check. Having screened thousands of tenants, we are sharing our expertise on this blog to highlight the top 5 key things to be aware of when reading a tenant credit report.

Here is a link to our sample report, it will be used as a reference throughout this article.

1. Credit Score

The number one tenant risk indicator that landlords need to review is the credit score. A credit score is a metric that encompasses everything including an individual’s financial standing and payment behaviour, debt and income. Information such as outstanding debt and late payments are also reflected in an individual’s credit score.

The average Canadian renter has a 630 credit score. This means that tenants with a score ranging from 600 to 700 are considered to have an average score. When reviewing applicants with a score below 600, landlords need to be more careful as this is a below-average score. A credit score below 500 can indicate poor payment behaviour or a recent bankruptcy, these are the riskiest applicants. While a low credit score doesn’t mean that a tenant will be delinquent on rent, we can safely assume that a tenant who doesn’t pay their bills on time, is more likely to not pay their rent on time. Sometimes when people file for bankruptcy they can be worried that they will be turned down as an applicant for many reasons, even if it was a one time mistake, so they may want to go down the route of looking into Milwaukee Chapter 13 Bankruptcy Attorneys or an attorney that is within their area so they can fight through this and help their credit score back up so they are not marked for life and can go for what they need.

2. Debt-How Much Debt and What Type of Debt?

Another key piece of information on credit reports is debt. While large amounts of any debt aren’t a great sign, it is important to understand that not all debt was created equally. Credit cards and risky loan options such as Payday loans are high-risk debt. The reason for this is because this form of debt comes with higher interest rates. Additionally, owing Payday loans are often the last resort for borrowers and can indicate that the tenant may be going through financial hardship.

On the other hand, debt categories like Mortgages and HELOCs (Home Equity Lines of Credit) are significantly less risky because of the lower interest rates and the asset securing the loan. Also, individuals can rent out their property to cover the mortgage payment. Student debt, car payments etc are forms of debt that aren’t as risky as credit cards or Payday loan debt. What is important here is whether the applicant has been able to make regular payments.

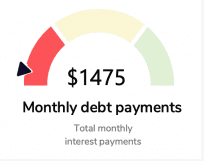

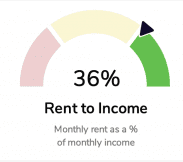

3. Monthly Debt Payments

Credit reports will outline the number of regular payments that a person has to pay towards items such as an auto loan, credit card, etc. It is important to consider these monthly payments because it means that a certain portion of the applicant’s income is predetermined. Here is an example of what SingleKey’s credit report will show. The “Payment Term Amount” shows how much money is to be paid, while the “Narrative” explains the frequency of payments.

For example, if the applicant’s income is $3000 per month (pre-tax) but they have to pay $1000 towards their credit card and car loan payments every month, this doesn’t leave much behind to cover rent and living expenses.

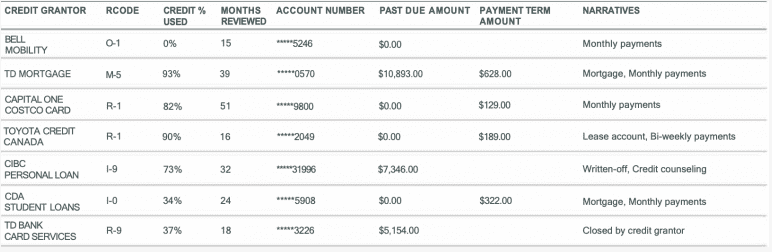

4. Rent-to-Income Ratio

It is important to know that the tenant can afford the expense of renting a unit. A landlord should consider how much the tenant makes monthly in comparison to how much they have to pay monthly for rent. SingleKey’s credit report calculates the rent to income ratio so you won’t have to worry about it.

For example, if the applicant makes $3000 per month (pre-tax) BUT they are applying for a unit where the rent is $2000 per month, this is a red flag. Looking at the applicant’s rent-to-income ratio gives you a good sense of affordability, and we suggest going one step further and using:

(Rent + Debt payments) to Income ratio since the monthly debt payments will affect affordability as well. In our experience affordability is one of the top predictors of tenant rent default. If a tenant is spending more than 50% of their income on rent, there won’t be much left, after taxes and living expenses, to save for a rainy day. So unexpected expenses or job loss would cause the tenant to stop paying rent.

5. Collections and Bankruptcies

Collection items and bankruptcy demonstrate financial responsibility. They will remain on a credit report for 6 years and have a significant impact on credit scores. While many groups can find the debt reclaimable via a respectable debt collection company, the fact that it has occured at all should be a point of pause for any potential loan offers. Collections and bankruptcy can happen, but it is important to ask the right questions when you see it on a credit report. Firstly, how much was the amount for? The amount owing is an important factor in determining how detrimental the outstanding payment is to the applicant. Second, when did it happen? In cases where a bankruptcy occurred 5 years ago, that is not nearly as important as if the bankruptcy is fresh. The older the bankruptcy. the less financial strain the applicant is under. Finally, what type of debt was it? If a collections item is for a Payday loan, that is much more worrisome than if it was an outstanding phone bill.

Ultimately, keeping these top 5 things in mind can help you get the most out of your credit report while also raising any red flags that you should be aware of. If you are looking for the best tool to screen your tenants, consider the SingleKey Credit and Background check report. It highlights these top 5 metrics at the very beginning of the report. SingleKey also offers a free tenant review call if you need help understanding the tenant report. Lastly, as a REIN member, you get a 20% discount if you order from our REIN partnership page.